Southern Cal Median Price Jumps 10 Percent: $484,000 in February 2017

Southern California Median Price Jumps 10 Percent Year-over-Year in February 2017 to $484,000, Home Sales Down 3.2 Percent

Rising Interest Rates and Lack of Inventory Persistent Drag-on Sales

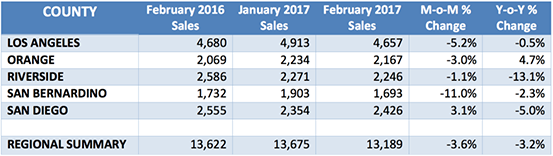

CALIFORNIA, MARCH 30, 2017 – Southern California February 2017 home sales fell 3.6 percent from January 2017 and were down 2.2 percent from February 2016. Four of five counties in the region experienced annual sales declines ranging from -0.5 percent in Los Angeles County to -13.1 percent in Riverside County. Orange County was the only county in the region that experienced a gain of 4.7 percent from a year earlier.

“Sales continue to be lackluster due to the persistent lack of inventory,” said Schnapp. “The recent jump in mortgage interest do not help but are certainly not the only culprit. Lack of inventory, especially at the affordable end of the spectrum continues to disappoint.”

Southern California Home Sales Summary - February 2017

Source: PropertyRadar, 2017

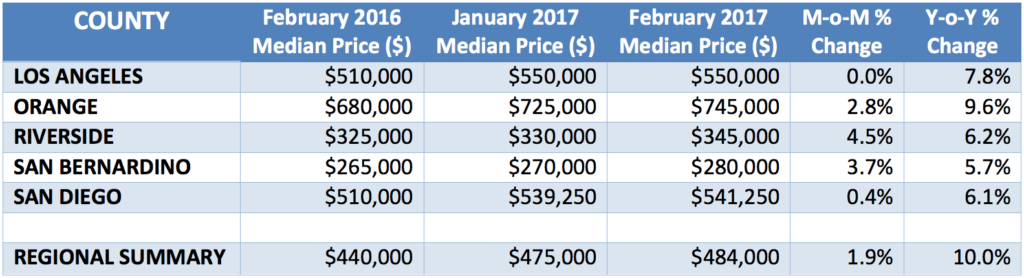

Southern California's median price in the region was $484,000, up 1.9 percent from January 2017 and up 10.0 percent from February 2016. At the county level, annual median price increases ranged from +5.7 percent in San Bernardino County to +9.6 percent in Orange County.

“Prices continue to march higher at a fairly rapid clip in the face of scarce inventory, rising costs, and lackluster sales,” said Schnapp. “In addition, California added 23,000 new jobs in February, lowering the state's unemployment rate to 5 percent, the lowest level in 10 years putting upward pressure on housing demand.”

Southern California Median Price Summary by County - February 2017

Source: PropertyRadar, 2017

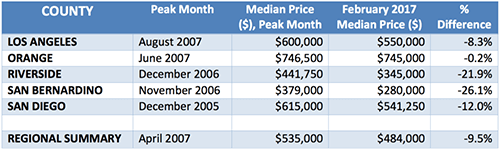

Despite the steady increase in home prices, overall they remain well below their previous pre-recession peaks. The exception is Orange County whose median prices have been oscillating slightly above or below their previous peak. In February 2017, the median home price in Orange County was 0.2% below its previous peak.

“Orange County continues to post stronger home sales and price increases relative to the Southern California region as a whole,” said Schnapp. “Local economists point to an increase in demand from rapid job and income growth in sectors such as construction, education, and healthcare. On the supply side, Orange County has seen a jump in new-home in recent months.”

Southern California Median Price by County Compared to the Prior Peak - February 2017

Source: PropertyRadar, 2017

The trajectories of mortgage interest rates and economic growth combined with the lack of inventory remain the biggest challenges to the California housing market in 2017.

“California’s healthy job market continues to fuel demand for affordable housing,” said Schnapp. “Unfortunately California’s difficult regulatory and permitting environment is a significant roadblock to supply. Add to that rising mortgage interest rates and inflation and the stage is set to keep our ‘Flat is the New Black’ market forecast intact.”

Southern California Home Sales

Southern California Home Sales – Total Single-family residence and condominium sales in the following counties: Los Angeles, Orange, Riverside, San Bernardino, San Diego. Sales are illustrated by month from 2005 to current and are divided into distressed and non-distressed sales. Distressed sales are the sum of short sales, where the home is sold for less than the amount owed, and REO sales, where banks resell homes that they took ownership of after foreclosure. All other sales are considered non-distressed.

Southern California Year-over-Year Home Sales

Year-over-Year Home Sales - Single-family residences and condominiums sold during the same month for the current year and prior years divided into distressed and non-distressed sales.

Southern California Median Sales Price

Southern California Median Sales Price – December median sales prices of a Southern California single-family home and the median sales price of homes within the individual counties in the region.

PropertyRadar Report Methodology

California real estate data presented by PropertyRadar, including analysis, charts, and graphs, is based upon public county records and daily trustee sale (foreclosure auction) results. Items are reported as of the date the event occurred or was recorded with the California County. If a county has not reported complete data by the publication date, we may estimate the missing data, though only if the missing data is believed to be 10 percent or less of all reported data.