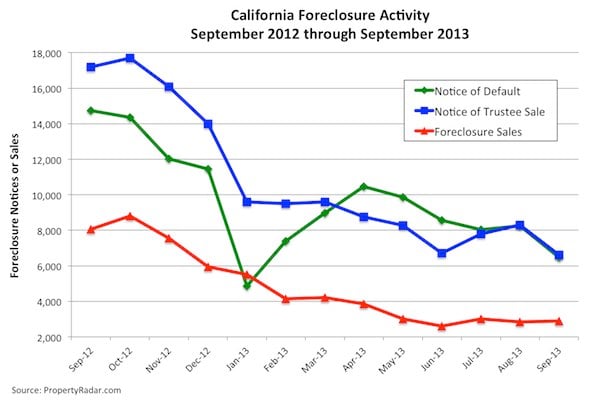

September California Foreclosure Activity Hits Seven Year Low

California foreclosure activity – Notices of Default, Notices of Trustee Sale and Foreclosure Sales – fell to its lowest level in seven years reflecting the ongoing recovery in the California real estate market and the impact of the California Homeowner Bill of Rights law.

California Notices of Default fell 21.6 percent in September, the largest one-month decline since March, and are down 56.1 percent for the year. Meanwhile, Notices of Trustee Sale were dropped 20.3 percent for the month and are down 61.5 percent for the year. Foreclosure sales gained 1.8 percent for the month but remain near their lowest levels in our records dating back to January 2007.

Splitting September foreclosure sales into their respective components — Sold to Third Party and Bank to Bank (REO) — Sold to Third Party sales fell 3.3 percent in September and are down 64.3 percent over the past 12 months. Meanwhile, REOs gained 5.3 percent in September but are down 63.8 percent over the past 12 months.

Bank REOs edged higher this past month because the largest banks resumed foreclosure sales following a temporary pause from mid-May to mid-July due to an Office of the Comptroller of the Currency (OCC) guidance letter that specified minimum standards for handling borrower files subject to foreclosure.

Foreclosure inventories declined in September following the downward trends in NODs and NTS. Preforeclosure inventories fell 8.3 percent in September and have fallen 47.7 percent in the past 12 months. Scheduled for Trustee Sale inventory fell 2.9 percent for the month and is down 71.6 percent for the year. Bank Owned (REO) inventory was nearly unchanged for the month, edging down 0.3 percent in September and declining 32.8 percent for the year.

.jpeg?width=450&height=306&name=5f4974d16b1e98b7cedbc020_ForeclosureInventories-Dec-06-2021-09-39-10-18-PM-1-1-1%20(1).jpeg)

Foreclosures have declined over the past year because:

- The pipeline of distressed property owners has been steadily shrinking as the California real estate market recovers and home prices march steadily higher. Rising home prices reduce the number of homeowners who owe more than their homes are worth making them eligible to refinance or sell their homes.

- The California Homeowner Bill of Rights prevents dual-tracking, which is lengthening the time to foreclose.

The double-digit one-month September decline in foreclosure activity was a surprise and suggests that the California real estate market is well on its way to recovery.

The double-digit one-month September decline in foreclosure activity was a surprise and suggests that the California real estate market is well on its way to recovery.

September Foreclosure Stats & Trends, by State

For a complete summary of August foreclosure stats and trends, please click on the following links:

Note: The numbers in parentheses indicate over-the-month changes.

California foreclosure stats and trends

Foreclosure starts: 6,641 (-19.5%)

Foreclosure sales: 2,907 (+1.9%)

Arizona foreclosure stats and trends

Foreclosure starts: 1,954 (-19.2%)

Foreclosure sales: 1,190 (-15.8%)

Nevada foreclosure stats and trends

Foreclosure starts: 4,978 (+150.2%)

Foreclosure sales: 788 (+23.7%)

Oregon foreclosure stats and trends

Foreclosure starts: 54 (+22.7%)

Foreclosure sales: 29 (-9.3%)

Washington foreclosure stats and trends

Foreclosure starts: 1,979 (-5.3%)

Foreclosure sales: 978 (-27.0%)