Reno Not Immune To California Housing Affordability Crisis

Reno Q1 New Home Sales Down 51.3 Percent over 2016, Retreat to 2014 Levels

Reno Median Home Price Rises to $345,000, Highest in Eleven Years

Builders Struggle to Keep Up with Demand

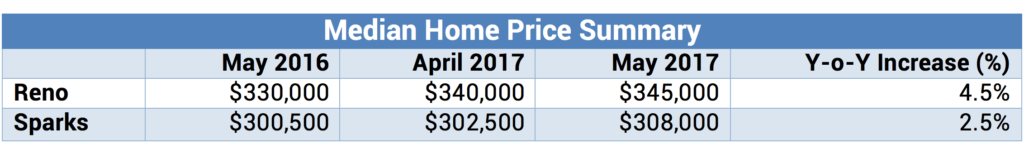

RENO, NEVADA JUNE 22, 2017 – May 2017 Reno single-family home and condominium sales increased 16.4 percent from April 2017 but were down 2.4 percent from May 2016. Year-to-date (January through May) sales were down 6.4 percent compared to a similar period in 2016. Meanwhile, the May 2017 median price of a Reno single-family home to $345,000, the highest in nearly 11 years. The current price was up 4.5 percent from $330,000 in May 2016 and up 32.7 percent from $260,000 three years ago in May 2014.

Reno Q1 New Home Sales Down 51.3 Percent over 2016, Retreat to 2014 Levels

“The Reno real estate market is experiencing some of the same market conditions plaguing California,” said Madeline Schnapp, Director of Economic Research for PropertyRadar. “Inadequate housing supply has smashed headlong into increasing demand resulting in anemic sales and declining affordability. Rapid job growth since 2011 has driven demand sky high, and builders simply can’t build new homes fast enough.”

It's Not a Bubble

“And just like in California, news of soaring prices amidst weak sales is fueling speculation that the Reno housing market is a housing bubble about to pop,” said Schnapp. “It’s not a housing bubble. It’s a market dislocation caused largely by government policy.”

“A housing bubble requires an increase in inventory combined with an unwarranted surge in prices followed by a decline in demand and a massive selloff,” said Schnapp. “Today’s high prices are due to a combination of factors. Demand is being fueled by market stimulus in the form plentiful jobs and government-backed low-interest, below market rate loans that require little down. Supply constraints are coming from burdensome regulations on new building, a lengthy permitting process and lack of qualified workers.”

In nearby Sparks, Nevada, sales jumped 40.4 percent from April and were up 6.7 percent from a year earlier. Year-to-date sales are down 13.4 percent compared to a year earlier. The Sparks median home price in May 2017 was $308,000, the highest in 10 years. May prices were up 1.8 percent from $302,500 in April 2017 and up 2.5 percent from $300,500 May 2016. Since May 2014, the median home price in Sparks has gained 29.3 percent from $238,250.

Reno Median Home Price Rises to $345,000, Highest in Eleven Years

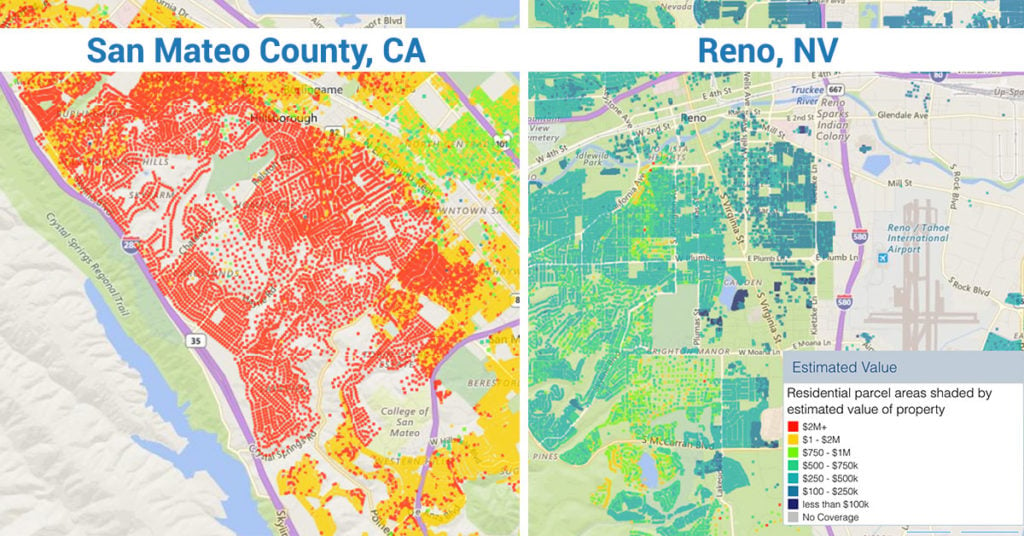

“With Reno’s proximity to Silicon Valley, comparatively lower cost of living, and its diversifying economy, it’s easy to see why Northern Nevada is attracting businesses and residents seeking to escape California’s acute housing crisis,” said Schnapp. “Despite the recent run-up in Reno home prices, they remain less than half the price of comparable homes in the San Francisco Bay Area. In San Mateo County, CA, a county located in the San Francisco Bay Area near Silicon Valley, comparable homes are selling for $750,000 to over $2 million.”

PropertyRadar’s “Estimated Value” heat map illustrates the price differential between the two markets. Red indicates properties whose values exceed $2 million, yellow $1-$2 million. Light green indicates properties whose values are in the $750,000 to $1 million range. Darker greens are below $750,000, and $500,000.

San Mateo County, CA vs. Reno, NV Home Values Visualized using PropertyRadar's Explore Data Visualizations

A significant factor depressing sales is the decline in new home sales, which is a direct reflection of new home construction. In Q1 2017, 175 new homes were sold compared to 359 new homes in Q1 2016, a 51.3 percent decrease.

Builders Struggle to Keep Up with Demand

“The number of new homes sold in the first quarter was the lowest since Q1 2012,” said Schnapp. “The reason has nothing to do with a decline in demand and everything to do with scarce inventory. Builders simply can’t bring new home inventory to market fast enough to meet demand.”

Median Price Trends

The median home price in Reno was $345,000 in May 2017, the highest in nearly 11 years, however, annual price appreciation in both Reno and Sparks has slowed.

“The slowdown in annual home price appreciation in both Reno and Sparks suggests home prices in some price categories may be nearing some resistance,” said Schnapp. “That’s good news for home buyers who want a little more time to shop.”

Median Home Price Summary

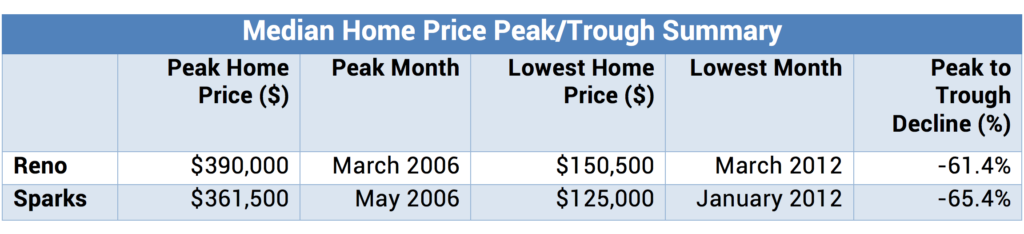

Source: PropertyRadar, 2017A look back at median home price trends in both Reno and Sparks provides context for the current price movements and are summarized in the table below. Reno, one of the hardest hit cities during the Great Recession, reached a median price low of $150,500 in March 2012. Median prices have recovered 129.2 percent since then to $345,000 in May 2017. Despite five years of rapid increases, median home prices remain 11.5 percent below the March 2006 peak of $390,000.

Median price trends in Sparks followed a similar pattern. Since reaching a low of $125,000 in January 2012, prices have increased 146.4 percent to $308,000 in May 2017 but remain 14.8 percent below the May 2006 peak of $361,500.

Median Home Price Peak/Trough Summary

Source: PropertyRadar, 2017

Conclusion

“While Reno has benefited from several years of forward-thinking, successful economic development that has resulted in solid business growth and plentiful new jobs,” said Schnapp. “Reno’s housing problem boils down to well-intentioned but flawed government policy.”

“Local, state, and federal regulations lengthen the permit process hampering builder’s efforts to meet housing demand in Reno’s growing economy,” said Schnapp. “Conceptually the solutions to Reno’s affordability and inventory crisis are simple. But politically we should expect the current situation to continue for the foreseeable future.”

“Scarce inventory, rising prices, and anemic sales is a familiar problem to many real estate market participants, especially in California, and Reno is not immune,” said Schnapp. “Reno’s rising home prices and limited supply mirrors California’s market dislocation problem arising from years of burdensome government policies that have severely constrained affordable home building. Reno’s strong economic recovery and the availability of low down payment, low-interest rate government sponsored mortgages only adds fuel to the median price fire.”

Monthly Sales Trends

Single Family Residences and Condominiums

Washoe County, Reno, Sparks, Nevada

Monthly Sales Trends – Total monthly single-family residence and condominium property sales. Black line illustrates Washoe County sales, Blue Line is Reno sales, Red line is Sparks sales.

Year-to-Date Sales Trends, Single Family Residences and Condominiums - Washoe County, Reno, Sparks, Nevada

Year-to-Date Sales Trends – Total year-to-date single-family residence and condominium property sales. Black line illustrates Washoe County sales, Blue Line is Reno sales, Red line is Sparks sales.

Median Home Price Trends (Single Family Residences)

Median Sales Price – Year-over-Year Trend, Current Month - median sales price of a single-family home in Washoe County, Reno and Sparks, Nevada.

PropertyRadar Report Methodology

Reno, Sparks, and Washoe County real estate data presented by PropertyRadar, including analysis, charts, and graphs, is based upon public county records and daily trustee sale (foreclosure auction) results. Items are reported as of the date the event occurred or was recorded with county. If a county has not reported complete data by the publication date, we may estimate the missing data, though only if the missing data is believed to be 10 percent or less of all reported data.

About PropertyRadar

With a mission to make targeted local marketing easy, PropertyRadar is the leading market intelligence and direct marketing platform for Investors, Realtors®, and Real Estate Professionals in CA, AZ, NV, OR & WA.

Over 10,000 Realtors®, Investors, and Real Estate Services Professionals have turned to PropertyRadar to discover market opportunities and connect with prospects.

PropertyRadar (previously known as ForeclosureRadar) is a web-based subscription service providing the leads, data, analysis, marketing, alerts, and automation needed to find opportunities, reduce risk, and increase productivity.