Real Property Report - California, October 2016

Sales Fall as Homes Priced Under $500,000 Disappear at a Rapid Clip

October Sales Down 7.3 Percent Year-over-Year

Median Prices Up 5.2 Percent Year-over-Year

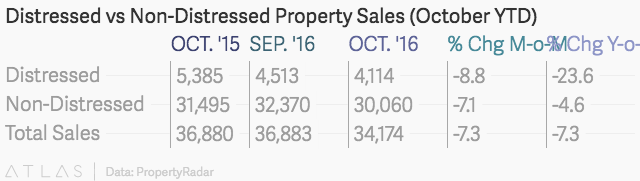

CALIFORNIA, NOVEMBER 30, 2016 – California single-family home and condominium sales fell 7.3 percent in October 2016 to 34,174 from 36,883 in September 2016. For the year, sales were down 7.3 percent from 36,880 in October 2015.

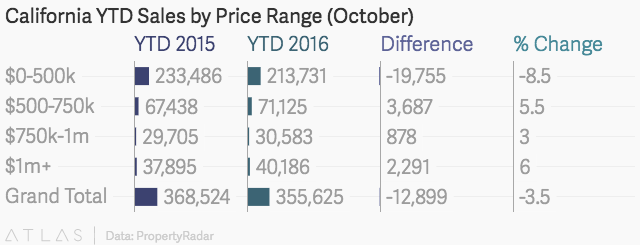

Year-to-date sales (January through October 2016) provide a longer-term view of the California property market. Year-to-date sales totaled 355,625 properties, down 3.5 percent from the same period in 2015. When year-to-date sales are divided into price categories (Table 1) a clearer picture emerges of what is driving sales trends. In 2016, 60.1 percent of sales were in the $0 to $500,000 price category. Sales in this lower priced category fell 8.5 percent relative to 2015. In the three other price categories ranging from $500,000 to over $1 million sales were higher.

Table 1 - January through October 2016 Sales

Source: PropertyRadar.com

“The drag on sales is coming from the decline in houses in the $0 to $500K price range,” said Schnapp. “That trend is being driven by several forces. Despite California’s robust economy and healthy demand for housing, years of regulatory building constraints have kept low-priced inventory from reaching the market. Meanwhile, rising prices push homes into higher priced categories pricing prospective buyers, whose real income has not kept pace with home price appreciation, out of the market.”

“Hopefully, builders, government, and lenders are getting the message that California’s real estate market needs lots more houses priced under $500,000,” said Schnapp. “Without an adequate supply of reasonably priced homes coming to market soon, California’s economy could come under strain as businesses and prospective buyers seek opportunities elsewhere.”

When sales are divided into distressed and non-distressed properties (Table 2), distressed property sales fell 8.8 percent for the month and were down 23.6 percent year-over-year. Meanwhile, non-distressed properties fell 7.1 percent for in October from September and were down 4.6 percent for the year.

California Property Sales

Source: PropertyRadar.com

The median price of a California home was impacted by seasonal forces this past month and fell 0.7 percent to $426,000 from $429,000 in September. Despite the monthly decline, prices were up 5.2 percent from $405,000 a year ago.

Within the 26 largest counties in California, on a year-ago basis, prices were higher in all but two counties. The counties with the largest annual price gains were located in the San Francisco Bay Area: Marin (+8.9 percent), San Francisco (+10.5 percent), San Mateo (11.4 percent) and Sonoma (+10.1 percent).

“Prices in the San Francisco Bay Area continue to defy current incomes,” said Schnapp. “Sales may be sluggish, but that hasn’t stopped buyers from continuing to pay nosebleed prices for housing. Gentrification continues in the Bay Area at a rapid clip as higher income tech workers displace non-tech residents.”

“The median priced home in San Mateo County in October cost $1.25 million,” said Schnapp. “That bought you a two-bedroom, one-bath dwelling built in 1945. For those homebuyers that can tolerate a longer commute, nearly $1.25 million bought you a beautiful 4,000 square foot luxury home on 0.75 acres located in the Sonoma County hills.”

Cash sales during the month of October fell 8.4 percent from September and were down 11.4 percent from October 2015. Year-to-Date cash sales were down 7.4 percent compared to the same period last year. So far this year, cash sales were 20.4 percent of total sales, down from 21.3 percent in 2015. Cash sales peaked in 2011 at 30.4 percent of sales in 2011.

The counties with the highest percentage of cash sales were San Francisco (26.7 percent), Marin (25.6 percent), Monterey (25.0 percent), Santa Cruz (25.0 percent) and San Luis Obispo (24.4 percent).

“Four of the five counties with the highest percentage of cash sales in California were located in San Francisco Bay Area,” said Schnapp. “The tech economy and rapid price appreciation continue to attract cash buyers despite high prices.”

When cash sales are divided into price categories, so far in 2016, 60 percent of cash sales were in the $0 to $500,000 price category, down from nearly 64 percent in 2015 and 68.1 percent in 2014. Similarly, 60 percent of non-cash sales were also in this category down from 63.2 percent in 2015 and 65.1 percent in 2014.

“Hopefully the need for lower priced homes is being heard loud and clear up and down the state,” said Schnapp. “Residential investment is expected to improve going forward. Let’s hope it’s in price categories that Californians can afford.”

In other California housing news:

- Flip Sales in October 2016 fell 9.5 percent for the month and were down 10.4 percent over the past 12 months. In general, flip sales are lower this year than last due to lack of inventory, slower appreciation and lower return on investment.

- Negative Equity. The number of homeowners in a negative equity position fell below 450,000, or 5.0 percent of homeowners in October. Since October 2015, 107,000, homeowners exited their negative equity positions, a decline of nearly 20 percent. While rising prices create an affordability problem, on the flip side, thousands of other homeowners can now participate in the housing market.

- Institutional Investor Purchases by LLC and LPs temporarily unavailable due to incomplete data at time of publication.

- Trustee Sale Purchases by LLC and LPs temporarily unavailable due to incomplete data at time of publication.

- Institutional Investor Sales by LLC and LPs temporarily unavailable due to incomplete data at time of publication.

- Foreclosure Notices. Notices of Default (NODs) were down 1.6 percent in October from September and down 22.2 percent in the past 12 months. Notices of Trustee Sale (NTS) were down 6.2 percent for the month and down 23.2 from September 2015. NODs have been on a gradual downward trend since January 2013 while NTS’ have been on a similar downward trajectory since January 2014.

- Foreclosure Sales were down 2.1 percent for the month and fell 21.3 percent from October 2015. Foreclosure sales have followed the gradual downward trend in NODs and NTSs and have been on a similar slow descent since May 2013.

Home Sales

Home Sales - Single-family residence and condominium sales by month from 2005 to current divided into distressed and non-distressed sales. Distressed sales are the sum of short sales, where the home is sold for less than the amount owed, and REO sales, where banks resell homes that they took ownership of after foreclosure. All other sales are considered non-distressed.

Year-over-Year Home Sales

Year-over-Year Home Sales - Single-family residences and condominiums sold during the same month for the current year and prior years divided into distressed and non-distressed sales.

Year-to-Date Home Sales

Year-to-Date Home Sales – The sum of year-to-date sales of single-family residences and condominiums for the current year and prior years divided into distressed and non-distressed sales.

Median Sales Prices vs. Sales Volume

Median Sales Price vs. Sales Volume - Median sales price (left axis) of a California single family home versus sales volume (right axis), by month from 2012 to current. Median sales prices are divided into three categories: All single-family homes (black line), distressed properties (red line), and non-distressed properties (blue line). Monthly sales volumes (right axis) are illustrated as gray and lavender bars. The gray bars are non-distressed sales, and the lavender bars are distressed sales.

California Homeowner Equity

California Home Owner Equity - A model estimate of California homeowners segregated into various categories of levels of homeowner equity for a given month. Homeowner numbers represent a percentage of total California homeowners.

Cash Sales

Cash Sales - The blue bars (right axis) illustrate cash sales of single-family residences and condominiums by month. The red line (left axis) illustrates cash sales as a percentage of total sales by month.

Flipping

Flipping – The number of single-family residences and condominiums resold within six months.

Foreclosure Notices and Sales

Foreclosure Notices and Sales - Properties that have received foreclosure notices — Notice of Default (green) or Notice of Trustee Sale (blue) — or have been sold at a foreclosure auction (red) by month.

Foreclosure Inventories

Foreclosure Inventory - Preforeclosure inventory estimates the number of properties that have had a Notice of Default filed against them but have not been Scheduled for Sale, by month. Scheduled for Sale inventory represents properties that have had a Notice of Trustee Sale filed but have not yet been sold or had the sale canceled, by month. Bank-Owned (REO) inventory means properties sold Back to the Bank at the trustee sale and the bank has not resold to another party, by month.

Real Property Report Methodology

California real estate data presented by PropertyRadar, including analysis, charts, and graphs, is based upon public county records and daily trustee sale (foreclosure auction) results. Items are reported as of the date the event occurred or was recorded with the California County. If a county has not reported complete data by the publication date, we may estimate the missing data, though only if the missing data is believed to be 10 percent or less of all reported data.