Probate Public Records: A Great List Source For Leads?

5 Strategies Real Estate Investors and Realtors Should Know About Using Probate Public Records as a Source of Leads

Like birth, death is a matter of public record. Probate public records reflect a court-supervised process of gathering a deceased person's assets and distributing them to creditors and inheritors.

Many investors and Realtors® consider probate to be one of many life events that can be a source of real estate leads, often categorized as motivated sellers. This is good reasoning as life events can and do result in property transactions.

The ability to leverage probate public records as an effective lead source drives many, often inexperienced, investors and Realtors® to snap up these probate public records lists as a source of lucrative leads.

Experienced investors and Realtors®, however, will tell you it’s complicated to leverage divorce public records as a source of leads. Why?

Experienced investors and Realtors® know their market and consistently identify and cultivate lead sources that produce results. They arrived at their go-to sources of leads often after years of trial and error.

Here are five things to know about probate public records that make them of less value than you might think.

1. Homes Worth Buying Are Protected from Probate

The first thing to know about probate deals is that the good ones are very rare.

Most Americans who own properties worth pursuing as an investment put their home in a revocable living trust, established beneficiary designations, or resolved by joint tenants with rights of survivorship.

America is more financially-savvy than ever, and we’re also living longer. These facts translate to an increasing amount of property owners divesting themselves of assets as they approach their last years and protecting their property from probate by streamlining the dissemination of their assets to heirs.

These factors alone immediately reduce the number of worthwhile leads derived from probate public records as suitable investment opportunity pursuits.

Realtors who know and cultivate relationships within their market have previously established themselves within that family’s sphere of influence are likely to be the first to become aware of a deal.

2. Probate Sales Are Complicated

Probate sales almost always take longer than traditional sales and reduces the value of pursuing them because, as all investors know: time kills deals.

While the occasional lower price can attract investors, know that Realtors® are encouraged to price a home as they would any other listing.

Offers on a probate sale must be accompanied by a 10% deposit, then confirmed by the court, and then assigned a sale date usually a month or more from when the offer was submitted.

Upon confirmation of the date, courts often raise the price per state law to attract more bids. An auction process then ensues. Sometimes the original bidder walks away with the property, sometimes a competitor takes the title.

Real estate investors should also know that their 10% deposit is not always refundable.

3. Obituaries Are the Better Lead Source

Real estate investors and Realtors® are interested in probate public records because it represents a life event and the potential for finding motivated or court-appointed sellers. Distress in a life event can be a sign that a deal is imminent.

But the term “probate” is a red herring.

The bigger form of distress is the death itself. Therefore, investors should start with obituaries.

Obituaries tend to run a few weeks after a person dies, a timeframe that is much more advantageous for the real estate investor or Realtor® to research the real estate assets of the deceased and identify the relationships that need to be established.

Don’t get caught waiting for the probate process to complete and for the probate public records to be published when most of what is useful was published in the local newspaper months before the court decided to file the record.

Plus, obituaries tend to share the names of a surviving spouse. According to the law of joint tenancy, a form of ownership under which most homes of married couples fall, property will end up in the hands of the remaining owner.

4. Probate Attorneys are Often Better Probate Lead Sources

Real estate investors and Realtors® who develop relationships with estate attorneys are at an advantage to discover probate leads long before the probate public record is made public.

A life event like death is a difficult subject and requires grace, tact, and earned trust. Sending an impersonal direct mail to someone without a formal introduction or strong third-party recommendation will result in few responses, and even fewer of them friendly.

Probate proceedings can result in bankruptcy, further delaying a real estate transaction until the bankruptcy is complete. At the same time, bankruptcy proceedings are visible and will likely attract even more competition to a yet-to-be certain deal.

It’s worth noting that one death can be followed by another, particularly in the case of joint tenants with rights of survivorship and not as tenants in common.

Often it is worthwhile to track the property and the individuals long after. This is the process of putting yourself into a sphere of influence by demonstrating your willingness to weather the ups and downs.

Also keep in mind that once a home enters the foreclosure process by way of a notice of default, it’s no longer an inside game—it’s on everyone else’s radar as well.

5. Nothing Beats Knowing Your Market and Direct Marketing

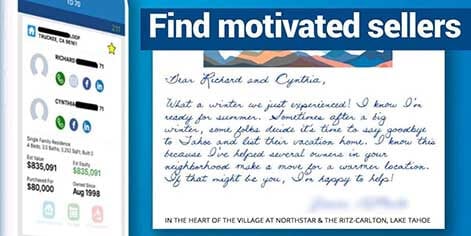

Even with sound attorney relationships in place and a habit of checking obituaries, nothing will prove more fruitful than using a tool like PropertyRadar to identify your market, glean insights from market intelligence, and routinely direct market to targeted local lists.

Create lists of properties and owners and set up alerts to track changes, both within PropertyRadar and by leveraging Google alerts (among many ways) to stay on top of anyone and everyone in your defined geographic market, sometimes referred to as a FARM.

We’ve found that real estate investors and Realtors® who work the occasional life event deal find it through direct marketing and the relationships they’ve cultivated over time. Then they use PropertyRadar to build lists and track activity. Direct marketing with postcards, letters, and neighborhood canvassing by way of door-knocking to perfect your lists all consistently prove to yield results.

Summary

In summary, the real value in finding probate-related real estate deals is not found in probate public record lists, it’s the actual life event that triggered it. Not blindly mailing to probate public records.

Savvy real estate investors and Realtors® who have profited from life event or distresses related investments have done so because of knowing their market, developing targeted lists, performing due diligence on those lists, developing a brand reputation, and personal relationships, and persistently direct marketing to those lists.