With unemployment rampant, the foreclosure crisis no longer can be blamed entirely on adjustable-rate loans, particularly the risky kind known as subprime mortgages.

With unemployment rampant, the foreclosure crisis no longer can be blamed entirely on adjustable-rate loans, particularly the risky kind known as subprime mortgages.

For the first time, fixed-rate prime loans — those typically given to people with the best credit — triggered the largest share of foreclosures initiated nationwide in the first quarter, according to a survey released Thursday by the Mortgage Bankers Association.

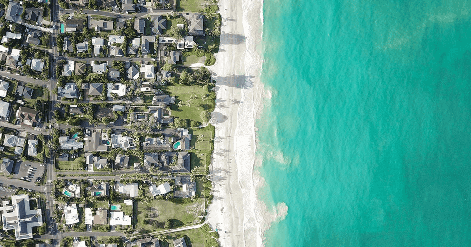

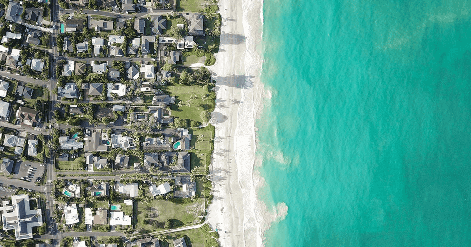

The development indicates that a “second wave” of the foreclosure crisis — caused by the recession and job losses, rather than subprime loans — is washing over the country.

Nationally, nearly 29 percent of foreclosure proceedings begun in the first three months of this year involved fixed-rate prime mortgages, the association said. That is up from about 25 percent in the fourth quarter last year and about 19 percent a year ago.

By contrast, subprime adjustable-rate mortgages, which represented 30 percent of foreclosures during the fourth quarter and 39 percent a year ago, accounted for just under 27 percent during the first three months of this year.

In California, most foreclosures still involve adjustable-rate mortgages, both subprime and prime. Experts say that’s because the state’s high cost of housing forces more people to rely upon those types of loans.

But fixed-rate prime loans are faltering here, too. They accounted for 19 percent of foreclosed mortgages in the first quarter of this year, up from about 11 percent in the fourth quarter and 8 percent a year ago.

Overall, the association reported, 12 percent of mortgages nationally were in trouble in the first quarter, either in foreclosure or past due by at least one payment. That is the highest level ever recorded.

Read more on mercurynews.com >