Foreclosure Activity Back Up As Stalemate Continues

Despite apparent declines, daily foreclosure activity is up on all fronts

Discovery Bay, CA, February 16, 2010 - PropertyRadar (www.foreclosureradar.com), the only website that tracks every California foreclosure and provides daily auction updates, issued its monthly California Foreclosure Report for January 2010. With hundreds of thousands of California homeowners in foreclosure, a stalemate continues as only a small percentage reach the end of the process through cancellation or sale, and the time to foreclose increases. Once again the raw numbers fail to tell the story on foreclosure activity due to the difference in a number of business days in January (19) vs. December (22). On a daily average basis foreclosure activity increased on all fronts.“With delinquent payments rising, foreclosures slowing, and foreclosure alternatives failing,” says Sean O’Toole, Founder, and CEO of ForeclosureRadar.com, “it appears the foreclosure crisis will be with us for many years to come”.

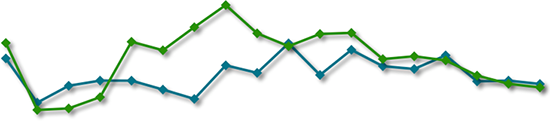

Foreclosure Filings

Notice of Default

| Prior Month | Prior Year |

| -5.38% | -36.58% |

Notice of Trustee Sale

| Prior Month | Prior Year |

| 4.74% | 8.98% |

After significant declines in December, Foreclosure Filings were slightly lower overall in January. With only 19 days that notices could be recorded in January, compared to 22 in December, foreclosure notice filings actually increased on a daily average basis with Notice of Default filings increasing by 9.5 percent from December, and Notice of Trustee Sale filings increasing by 10.3 percent.

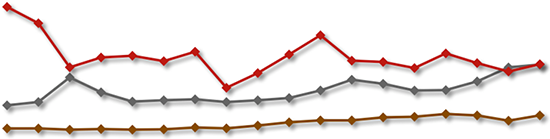

Foreclosure Outcomes

Back to Bank (REO)

| Prior Month | Prior Year |

| 11.72% | -4.20% |

Cancellations

| Prior Month | Prior Year |

| 4.32% | 106.24% |

Sold to 3rd Party

| Prior Month | Prior Year |

| 40.55% | 312.991% |

Like filings above, Foreclosure Outcomes also dramatically reversed course from the prior month. With significant increases in all outcomes, especially on a daily average basis, the number of foreclosures that went Back to the Bank rose 29.4 percent, Sold to 3rd rose by 62.7 percent, and Cancellations by 20.8 percent. While these increases were significant, a smaller percentage of foreclosures Scheduled for Sale completed the process in January 2010 (21 percent), than a year earlier (31 percent).

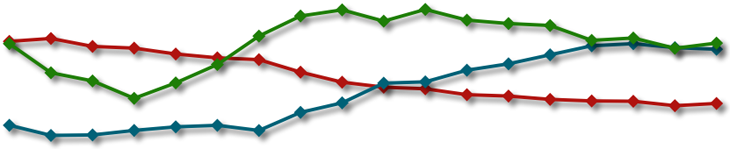

Foreclosure Inventories

Preforeclosure

| Prior Month | Prior Year |

| 3.55% | 16.55% |

Scheduled for Sale

| Prior Month | Prior Year |

| -1.08% | 110.42% |

Bank Owned (REO)

| Prior Month | Prior Year |

| 2.57% | -33.44% |

The total number of properties in the foreclosure process remains near record levels in California despite declines in new Notice of Default filings over the last year, largely due to the increase in the time it is taking banks to foreclose, which we cover in a new measure, Time to Foreclose, in this months report. Once Bank Owned (REO) properties are listed for sale they continue to sell quickly, leaving banks with lower than expected inventories.

*Note that we have altered our methodology for calculating Preforeclosure Inventories from introducing it last month.

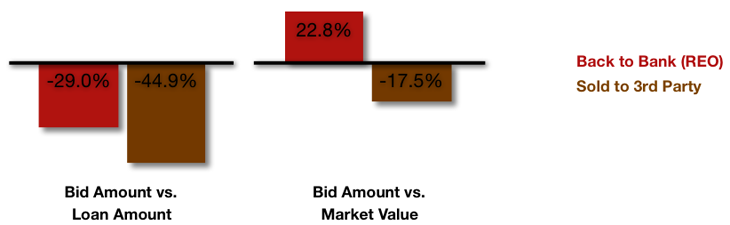

Foreclosure Discounting

While sales to 3rd Parties increased in January, the average discount on trustee sale purchases narrowed. The average discount 3rd Parties received from market value dropped from 18.6 percent in December to 17.5 percent in January. Banks are not discounting opening (or drop) bids at auction as aggressively as in the past and investors are reporting increased competition at the auctions, resulting in higher bid amounts.

Foreclosure Timeframes

Time to Foreclosure

| Prior Month | Prior Year |

| 3.31% | 19.61% |

Time to Resell - Bank

| Prior Month | Prior Year |

| 0.00% | 2.75% |

Time to Resell - 3rd Party

| Prior Month | Prior Year |

| 5.67% | -22.80% |

Despite prices now well below 2004 levels in many areas, loans made in 2004 and earlier remain a very small percentage of foreclosures.

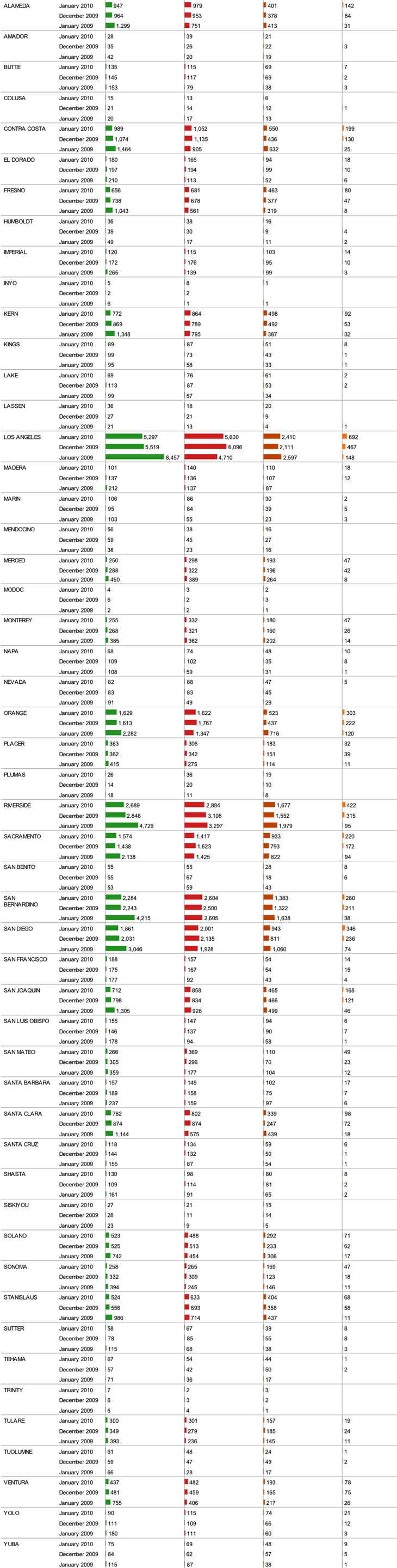

Foreclosure Activity By County

Notice of DefaultNotice of Trustee SaleBack to Bank (REO)Sold to3rd Party