California Foreclosure Filings Up 10.0 Percent In February

California foreclosure filings — the sum of Notices of Default and Notices of Trustee Sale — rose 10.0 percent in February after plummeting 43.4 percent in January. Despite the uptick in February, the longer-term downtrend in foreclosures remains intact as the California Homeowner Bill of Rights and the $25 Billion National Mortgage Settlement encourage banks and homeowners to pursue short sales, principal balance reduction loan modifications, second-lien extinguishment, and other forms of debt relief rather than foreclosures.

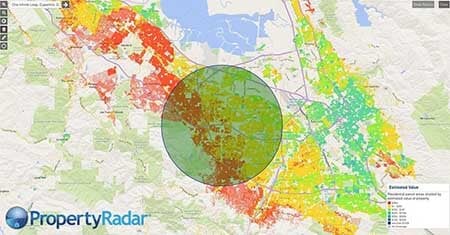

While policymakers state that the purpose of government intervention is to help homeowners by delaying foreclosures, instead they have created an artificial shortage in bank-owned inventory (REO). The combination of the decline in REO inventory and lack of motivated sellers has left the California real estate market with an acute lack of inventory, which is putting upward pressure on prices.

Foreclosures may be declining, but distressed property sales are still very much a part of the California real estate landscape. In fact, thanks to the National Mortgage Settlement, short sales increased dramatically in 2012.

Notices of Default, the first stage of the foreclosure process, rose 41.3 percent in February, the first gain since July 2012. While the one-month gain in February was large in percentage terms, the longer-term downtrend has held firm. In fact, February 2013 Notices of Default hit the second-lowest level since we began tracking the data in September 2006. For the year, Notices of Default were down 63.9 percent.

Notices of Trustee Sale edged lower in February, falling 5.9 percent for the month and 59.0 percent for the year.

Meanwhile, foreclosure sales in February totaled 4,103, down 25.4 percent for the month and 59.3 percent for the year. If we divide February foreclosure sales into their respective components — Sold to Third Party and Bank to Bank (RE0) — REOs are below Sold to Third Party for the first time since September 2006.

Note: Total foreclosure sales equal the sum of Sold to 3rd Party plus Back to Bank (REO).

Source: PropertyRadar.com

Best,

Madeline Schnapp

Director of Economic Research

PropertyRadar.com

530-550-8801 x27

Follow Us:

Facebook | Twitter | LinkedIn | Google+ | Pinterest | SlideShare

About ForeclosureRadar®:

PropertyRadar.com features unprecedented tools to search, manage, track and analyze pre-foreclosure, foreclosure auction, short sale, and bank-owned real estate. ForeclosureRadar has been serving its customers for over four years and counts several thousand investors, Realtors®, government agencies, and other professionals among its subscribers. ForeclosureRadar has been cited as an authoritative source by Bloomberg, 60 Minutes, Wall Street Journal, Associated Press, and other leading media outlets.

The company was launched by Sean O’Toole in May 2007. Prior to starting ForeclosureRadar, Sean spent 15 years building and launching software companies before entering the foreclosure business in 2002. From 2002 through 2006 Sean successfully bought and sold more than 150 foreclosure properties. ForeclosureRadar is privately held and based in the North Lake Tahoe area.